The Technical Analyst

The Technical AnalystExchange: NYSE Sector: Financial Services Industry: Asset Management

Nuveen Select Tax-Free Price, Forecast, Insider, Ratings, Fundamentals & Signals

-0.20% $15.04

America/New_York / 31 des 1970 @ 19:00

| PE RATIO: COMPANY / SECTOR |

|---|

| 2.26x |

| Company: PE 22.38 | sector: PE 9.91 |

| PE RATIO: COMPANY / INDUSTRY |

|---|

| 1.12x |

| Company: PE 22.38 | industry: PE 20.04 |

| DISCOUNTED CASH FLOW VALUE |

|---|

| N/A |

| N/A |

| Expected Trading Range (DAY) |

|---|

|

$ 14.87 - 15.22 ( +/- 1.16%) |

| ATR Model: 14 days |

Insider Trading

| Date | Person | Action | Amount | type |

|---|---|---|---|---|

| 2020-11-16 | Thornton Matthew Iii | Buy | 0 | |

| 2017-08-02 | Siffermann William A | Buy | 0 | |

| 2017-07-03 | Robert Young L | Buy | 0 | |

| 2016-07-01 | Moschner Albin F | Buy | 0 | |

| 2016-06-15 | Jones Nathaniel T. | Buy | 0 |

| INSIDER POWER |

|---|

| 0.00 |

| Last 3 transactions |

| Buy: 0 | Sell: 0 |

Live Trading Signals (every 1 min)

10.00

Buy

Last version updated: Fri April 15th, 2022

| Indicator Signals | |

|---|---|

| RSI 21 | |

| SMA | |

| Trend | |

| Trend 2 | |

| Trend 3 | |

| MACD |

| Volume Signals | |

|---|---|

| Price | $15.04 (-0.20% ) |

| Volume | 0.0385 mill |

| Avg. Vol. | 0.0258 mill |

| % of Avg. Vol | 148.99 % |

| Signal 1: | |

| Signal 2: |

Today

Last 12 Months

RSI

Last 10 Buy & Sell Signals For NXQ

0 Signals | Accuracy: 0.00% | Accuracy Buy: 0.00% | Accuracy Sell: 0.00%

Avg return buy: 0.00 % | Avg return sell: 0.00 %

$1 invested is now $1.00 or 0.00% since Coming Soon

| Date | Signal | @ | Closed | % |

|---|

NXQ

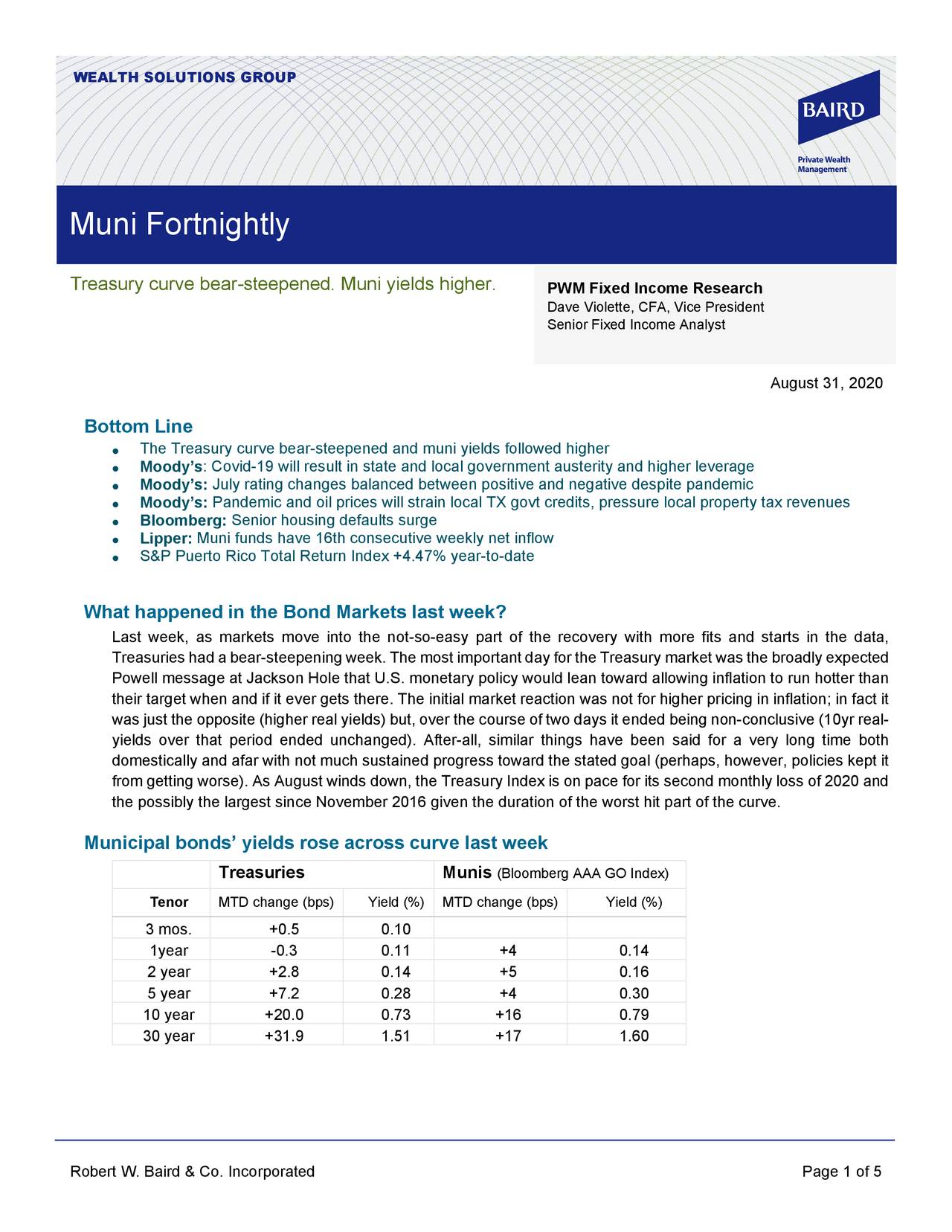

Nuveen Select Tax-Free Income Portfolio 2 is a diversified closed-end management investment company. The Fund's investment objective is that it seeks to provide current income and stable dividends, exempt from regular federal and designated state income taxes, where applicable, consistent with the preservation of capital by investing primarily in a portfolio of municipal obligations. The Fund's portfolio composition includes various sectors, such as tax obligation/limited, tax obligation/general, healthcare, transportation, consumer staples, the United States guaranteed and Other. The Fund's portfolio spans various states and territories, including California, Illinois, Texas, New Jersey, Colorado, Washington, Florida, Virginia, New York, Missouri, Iowa, Michigan, Minnesota, Nevada and Other. The Fund's investment advisor is Nuveen Fund Advisors, LLC, which is a subsidiary of Nuveen Investments, Inc. (Nuveen).

Latest Press Releases

Latest News